In this case study, we will analyze how XCALLY enabled Fido, a client of Partner Maxin Solutions Ltd., to implement a tailored and innovative project in the financial field.

Who is the client

Fido is a renowned financial technology company founded in 2014.

Fido has established itself as one of the leading providers of digital credit services in Ghana and Uganda. It is recognized for its innovative approach to financial inclusion and ability to offer fast and reliable financial services to a growing customer base.

Key features and strengths

- Technology integration: Uses advanced technologies to assess creditworthiness and provide instant loans.

- Accessibility: Provides financial services to individuals who do not have access to traditional banking services.

- User-friendly platform: Offers an intuitive and easy-to-use platform for loan requests and financial management.

- Speed: Ensures rapid loan disbursement.

- Credit building: Helps users build a credit history and improve their financial well-being.

Client’s Needs and Requests

Why did the company contact XCALLY?

Fido contacted XCALLY because they were having difficulties manually contacting clients. The previous tool used allowed them to reach only one customer at a time, significantly limiting their productivity. The client needed a solution to improve operations and increase efficiency.

What were their needs?

Initially, Fido’s main interest had focused on a solution involving an automated telephone dialer. Upon checking the various alternatives however, the client settled on XCALLY because of the ability to easily integrate with their local SIP Trunk. In addition, the presence of an XCALLY partner in Nigeria, Maxin Solutions Ltd., close to their home region, influenced the decision.

What services did they request and what were the established objectives?

The customer initially chose a Telephone Dialer, specifically to automate a number of processes that would allow them to send automated notifications to customers based on their status throughout the loan process, significantly improving communication and results.

What XCALLY has accomplished for the client

Fido started with XCALLY’s Dialer feature and later implemented a custom-designed IVR (Interactive Voice Response) system.. They also integrated the SMS module, linking it to the IVR.

Achieved results

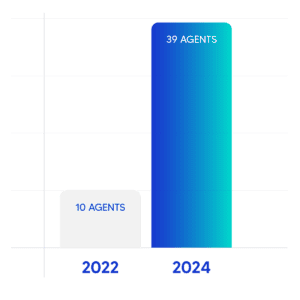

The client has started using the XCALLY in December 2022 with only 10 agents, and has experienced significant growth since then. Currently, Fido sees a total of 41 agents spread across its offices in Ghana and Uganda. Along the way, the company recognized the importance of improving customer communication, which led to the integration of the XCALLY SMS module and implement an IVR system. These implementations made it possible to better manage each customer’s requests, improving the customer journey and user experience and thus the overall service quality.

When asked about their experience with XCALLY’s contact center solution, Fido emphasized the comfort and stability it provides, making it an essential tool for their ongoing success.

Conclusion

Leveraging XCALLY’s powerful contact center solution, Fido has successfully improved operational efficiency, enhanced customer communication, and achieved significant business growth. The advanced features of XCALLYsuch as the automated telephone dialer, IVR logic, and SMS module, have enabled Fido to offer fast and reliable financial services, contributing to their mission of financial inclusion in Africa.